Vireo Health Announces Third Quarter 2019 Financial Results

Vireo Health Announces Third Quarter 2019 Financial Results

– Total revenue of $8.0 million increased 62 percent year-over-year –

– Two Green Goods retail dispensaries now open in Pennsylvania –

– Company welcomes Bruce Linton as Executive Chairman and Shaun Nugent as CFO –

MINNEAPOLIS – November 27, 2019 – Vireo Health International, Inc. (“Vireo” or the “Company”) (CNSX: VREO; OTCQX: VREOF), a science-focused, multi-state cannabis company with operations in 10 states and the Commonwealth of Puerto Rico, today reported financial results for its third quarter ended September 30, 2019. All currency figures referenced in this release reflect U.S. dollar amounts.

“We continued gaining sales momentum in our Maryland and Pennsylvania markets during the third quarter, and we also began seeing the benefits of capacity upgrades in our recently acquired Arizona business,” said Founder & CEO, Kyle Kingsley, M.D. “Near-term profitability has been impacted by the under absorption of overhead costs in early-stage markets where revenues are just beginning, but we’re anticipating performance improvement in the coming quarters, especially given the positive demand trends and patient enrollment growth we’re experiencing across most of our operating footprint.”

Dr. Kingsley continued, “We believe that our two recently opened Green Goods retail dispensaries in Pennsylvania will serve as an immediate catalyst for growth during the fourth quarter, and increasing sales of our branded products to third-party dispensaries should also remain an important driver of market share gains in the future. Additionally, heading into 2020, we feel we’re well positioned to benefit from potential regulatory tailwinds as most of our current operations are in medical markets that we believe are on the cusp of adult-use legalization.”

Business Highlights

- The Company generated operating revenue in seven states during the third quarter of 2019: Arizona, Maryland, Minnesota, New Mexico, New York, Ohio, and Pennsylvania. Total revenue for Q3 2019 increased 62 percent to $8.0 million versus Q3 2018.

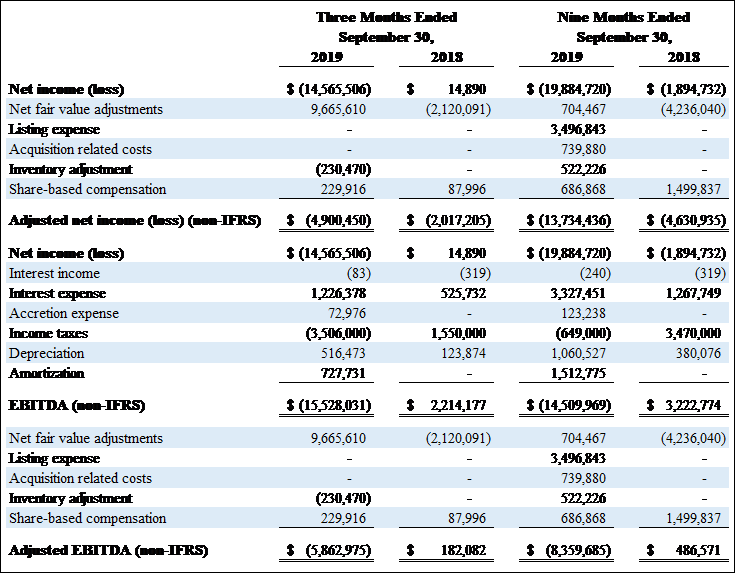

- Net loss for Q3 2019 was $14.6 million, as compared to net income of $14,890 in the prior year quarter, with the variance driven by lower gross profit and increased operating and interest expenses. Adjusted net loss, as described in accompanying disclosures and footnotes, was $4.9 million in Q3 2019, as compared to adjusted net loss of $2.0 million in the prior year quarter.

- Q3 2019 EBITDA and Adjusted EBITDA, as described in accompanying disclosures and footnotes, were a loss of $15.5 million and loss of $5.9 million respectively, as compared to positive $2.2 million and $182,082, respectively, during the prior year quarter.

- On August 15, 2019, Vireo’s affiliate Ohio Medical Solutions was granted a Certificate of Operation by the Ohio Department of Commerce and begin operating immediately. As of that date, Vireo was one of only five licensed processors operational in the State of Ohio.

- During the third quarter, the Company introduced new products in its Maryland wholesale channel, including whole-plant rosin extracts and a low-THC pre-roll offering. These followed the addition of vegetarian soft gel capsules in Pennsylvania late in the second quarter.

Third Quarter 2019 Financial Summary

Total revenue for Q3 2019 was $8.0 million, up 62 percent from $4.9 million in Q3 2018. Revenue growth was driven by increased patient counts in Minnesota and wholesale revenue generation in the states of Maryland and Pennsylvania, and contributions from recently closed acquisitions in Arizona and New Mexico.

Retail revenue was approximately $6.2 million in Q3 2019, an increase of approximately 26 percent compared to $4.9 million in Q3 2018. Wholesale revenue was $1.8 million in Q3 2019 and reflected revenue contributions from wholesale markets in Arizona, Maryland, New York, Ohio, and Pennsylvania.

Gross profit before fair value adjustments was $1.3 million, or 16 percent of revenue, as compared to $2.9 million or 60 percent, in the same period last year. The variance in gross profit before fair value adjustments as compared to the prior year was primarily driven by under absorption of overhead costs in certain states, as well as a greater mix of wholesale versus retail sales as compared to the prior-year quarter.

Total operating expenses were $8.6 million, as compared to $3.0 million in the same period last year. Total operating expenses include selling, general and administrative (“SG&A”) expenses, which totaled $4.2 million, as compared to $795,500 last year. The increase in total operating expenses was primarily attributable to increased salaries and wages, professional fees, and general and administrative expenses to support the Company’s growing business and operations as a public company, including $1.4 million in start-up expenses related to buildout and pre-revenue operations in certain state-based markets.

Total other expense was $1.1 million during Q3 2019. These non-operating expenses primarily reflect interest expense from the capital leases of the cultivation and manufacturing facilities in Maryland, Minnesota, New York, Ohio, Pennsylvania, and Puerto Rico.

Net loss in Q3 2019 was $14.6 million, as compared to net income of $14,890 in Q3 2018. Adjusted net loss for Q3 2019 was $4.9 million, as compared to a loss of $2.0 million in the prior year quarter.

Q3 2019 EBITDA was a loss of $15.5 million, as compared to positive $2.2 million in Q3 2018. Adjusted EBITDA was a loss of $5.9 million in Q3 2019, as compared to positive $182,082 in Q3 2018. Please refer to the Supplemental Information and Reconciliation of Non-IFRS Financial Measures at the end of this press release for additional information.

Other Developments

On November 7, 2019, the Company announced that Bruce Linton was appointed to the Company’s Board of Directors as Executive Chairman. Mr. Linton is the founder and former CEO of Canopy Growth Corporation. He is expected to work closely with Vireo’s Chief Executive Officer, Kyle Kingsley, M.D., to help spearhead the Company’s strategic decision-making, capital markets activity and future partnerships.

On November 14, 2019, the Company announced that Shaun Nugent had been appointed to the role of Chief Financial Officer, effective December 2, 2019. Mr. Nugent is a seasoned financial executive with more than 25 years of experience as CEO and CFO of several public and private companies, including Life Time Fitness, Champps Entertainment, and Sun Country Airlines. Vireo’s current CFO, Amber Shimpa, will be transitioning to the role of Chief Administrative Officer on December 2, 2019, in conjunction with Mr. Nugent’s appointment.

Balance Sheet and Liquidity

As of September 30, 2019, total current assets were $57.6 million, including cash on hand of $16.4 million. Total current liabilities were $6.2 million, with $1.0 million of debt currently due within 12 months. Effective November 13, 2019, the Company’s current portion of long-term debt in the amount of $1,010,000 was increased to $1,110,000 and extended to December 31, 2021.

As of September 30, 2019, there were 24,300,092 equity shares issued and outstanding, and 110,331,667 shares outstanding on an as converted, fully-diluted basis.

As of November 21, 2019, the Company had total cash available of $12.3 million, inclusive of $1.1 million in collectible receivables and reimbursements.

“We’ve made several important strategic investments in our business over the past two quarters, and cash outlays are subsiding as we’ve taken proactive measures to maintain our financial flexibility,” said Chief Financial Officer, Amber Shimpa. “Moving forward, we will only deploy capital where we expect near-term returns on investment, and we’re in a fortunate position where our highest ROI opportunities are fully-funded through tenant improvement funds provided by our real estate partners. We believe the relative strength of our balance sheet, combined with planned spending reductions, lower capex, and expectations for continued revenue growth provide us with a clear path to profitability.”

Outlook Commentary

Dr. Kingsley commented, “While we remain confident that our focus on bringing the best of medicine, science, and engineering to the cannabis industry will create compelling long-term value for all of our stakeholders, recent market conditions have prompted us to delay the pace of certain development projects. As a result of these decisions, we now expect to finish calendar year 2019 with a total of 13 operational dispensaries compared to our previously targeted range of 16 to 20.”

Kingsley concluded, “Despite the near-term challenges our industry is facing, we believe Vireo is in a unique position to emerge as a true sector leader given the relative strength of our balance sheet compared to many of our peers. With virtually no debt, we control our own destiny and our lean operations and disciplined approach to capital allocation provide us a clear path to profitability. We have an extremely attractive collection of licenses and strategic assets with significant long-term potential, and we’re looking forward to better showcasing the strength of our portfolio next year.”

Conference Call and Webcast Information

Vireo Health management will host a conference call with research analysts on Wednesday, November 27, 2019 at 8:30 a.m. ET to discuss its financial results for its third quarter ended September 30, 2019. The conference call may be accessed by dialing 866-211-3165 (Toll-Free) or 647-689-6580 (International) and entering conference ID 5293509.

A live audio webcast of this event will also be available in the Events & Presentations section of the Company’s Investor Relations website at https://investors.vireohealth.com/events-and-presentations/default.aspx and will be archived for one year.

Additional Information

Additional information relating to the Company’s third quarter 2019 results is available on SEDAR at www.sedar.com. Vireo Health refers to certain non-IFRS financial measures such as adjusted net income, Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) and adjusted EBITDA (defined as earnings before interest, taxes, depreciation, amortization, less certain non-cash equity compensation expense, one-time transaction fees, and other non-cash items. These measures do not have any standardized meaning prescribed by IFRS and may not be comparable to similar measures presented by other issuers. Please see the Supplemental Information and Reconciliation of Non-IFRS Financial Measures at the end of this news release for more detailed information regarding non-IFRS financial measures.

About Vireo Health International, Inc.

Vireo Health International, Inc.’s mission is to build the cannabis company of the future by bringing the best of medicine, engineering and science to the cannabis industry. Vireo’s physician-led team of more than 400 employees provides best-in-class cannabis products and customer experience. Vireo cultivates cannabis in environmentally friendly greenhouses, manufactures pharmaceutical-grade cannabis extracts, and sells its products at both company-owned and third-party dispensaries. The Company currently is licensed in eleven markets including Arizona, Maryland, Massachusetts, Minnesota, New Mexico, New York, Nevada, Ohio, Pennsylvania, Puerto Rico, and Rhode Island. For more information about the company, please visit www.vireohealth.com.

Forward-Looking Statement Disclosure

This news release contains forward-looking information within the meaning of applicable securities laws, based on current expectations. Generally, any statements that are not historical facts may contain forward-looking information, and forward-looking information can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “look forward to”, “budget” “scheduled”, “estimates”, “forecasts”, “will continue”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or indicates that certain actions, events or results “may”, “could”, “would”, “might” or “will be” taken, “occur” or “be achieved.” Forward looking information may include, without limitation, statements regarding the operations, business, financial condition, expected financial results, performance, prospects, opportunities, priorities, targets, goals, ongoing objectives, milestones, strategies and outlook of Vireo, and includes statements about, among other things, future developments, the future operations, potential market opportunities, strengths and strategy of the Company. Forward-looking information is provided for the purpose of presenting information about management’s current expectations and plans relating to the future and readers are cautioned that such statements may not be appropriate for other purposes. These statements should not be read as guarantees of future performance or results. These statements are based upon certain material factors, assumptions and analyses that were applied in drawing a conclusion or making a forecast or projection, including Vireo’s experience and perceptions of historical trends, current conditions and expected future developments, as well as other factors that are believed to be reasonable in the circumstances.

Examples of the assumptions underlying the forward-looking statements contained herein include, but are not limited to those related to: the achievement of goals, the closing of acquisitions, obtaining of necessary permits and governmental approvals, future market positioning, as well as expectations regarding availability of equipment, skilled labor and services needed for cannabis operations, intellectual property rights, development, operating or regulatory risks, trends and developments in the cannabis industry, business strategy and outlook, expansion and growth of business and operations, the timing and amount of capital expenditures; future exchange rates; the impact of increasing competition; conditions in general economic and financial markets; access to capital; future operating costs; government regulations, including future legislative and regulatory developments involving medical and recreational marijuana and the timing thereto; receipt of appropriate and necessary licenses in a timely manner; the effects of regulation by governmental agencies; the anticipated changes to laws regarding the recreational use of cannabis; the demand for cannabis products and corresponding forecasted increase in revenues; and the size of the medical marijuana market and the recreational marijuana market.

Although such statements are based on management’s reasonable assumptions at the date such statements are made, there can be no assurance that it will be completed on the terms described above and that such forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such forward-looking information. Accordingly, readers should not place undue reliance on the forward-looking information. Vireo assumes no responsibility to update or revise forward-looking information to reflect new events or circumstances unless required by applicable law.

By its nature, forward-looking information is subject to risks and uncertainties, and there are a variety of material factors, many of which are beyond the control of the Company and that may cause actual outcomes to differ materially from those discussed in the forward-looking statements. These factors include, but are not limited to: denial or delayed receipt of all necessary consents and approvals; need for additional capital expenditures; increased costs and timing of operations; unexpected costs associated with environmental liabilities; requirements for additional capital; reduced future prices of cannabis; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the cannabis industry; delays in obtaining governmental approvals, permits or financing or in the completion of development or construction activities; title disputes; claims limitations on insurance coverage; risks related to the integration of acquisitions; fluctuations in the spot and forward price of certain commodities (such as diesel fuel and electricity); changes in national and local government legislation, taxation, controls, regulations and political or economic developments in the countries where the Company may carry on business in the future; liabilities inherent in cannabis operations; risks relating to medical and recreational cannabis; cultivation, extraction and distribution problems; competition for, among other things, capital, licences and skilled personnel; risks relating to the timing of legalization of recreational cannabis; changes in laws relating to the cannabis industry; and management’s success in anticipating and managing the foregoing factors.

Supplemental Information

The financial information reported in this news release is based on audited financial statements for the fiscal year ended December 31, 2018, and unaudited condensed interim consolidated financial statements for the fiscal quarter ended June 30, 2019. All financial information contained in this news release is qualified in its entirety with reference to such financial statements. To the extent that the financial information contained in this news release is inconsistent with the information contained in the Company’s audited financial statements, the financial information contained in this news release shall be deemed to be modified or superseded by the Company’s audited financial statements. The making of a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation for purposes of applicable securities laws.

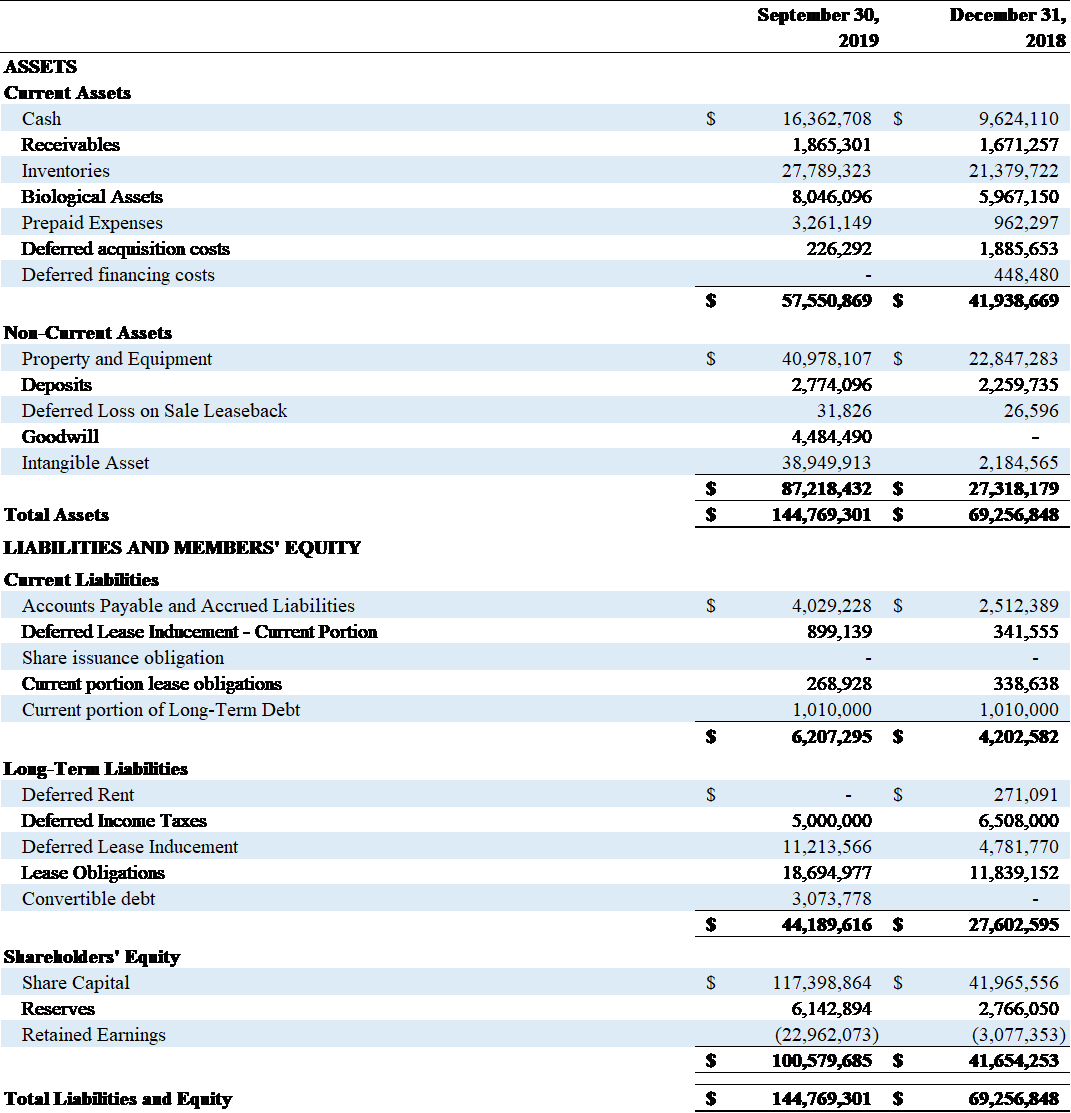

VIREO HEALTH INTERNATIONAL, INC.

(FORMERLY DARIEN BUSINESS DEVELOPMENT CORP.)

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF FINANCIAL POSITION

(unaudited)

September 30, 2019 and December 31, 2018

(Expressed in United States Dollars)

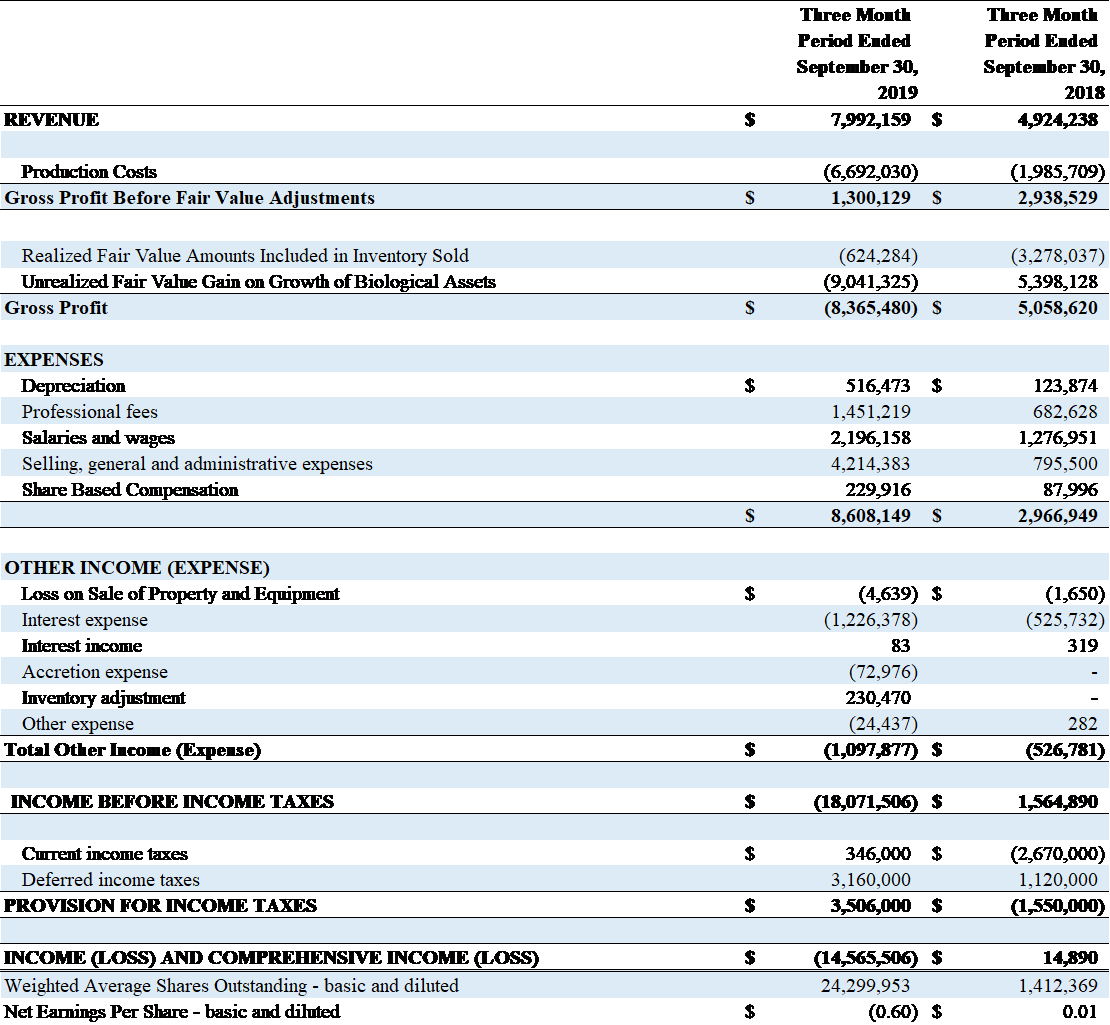

VIREO HEALTH INTERNATIONAL, INC.

(FORMERLY DARIEN BUSINESS DEVELOPMENT CORP.)

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF LOSS AND COMPREHENSIVE LOSS

(unaudited)

For the Three Months Ended September 30, 2019 and 2018

(Expressed in United States Dollars)

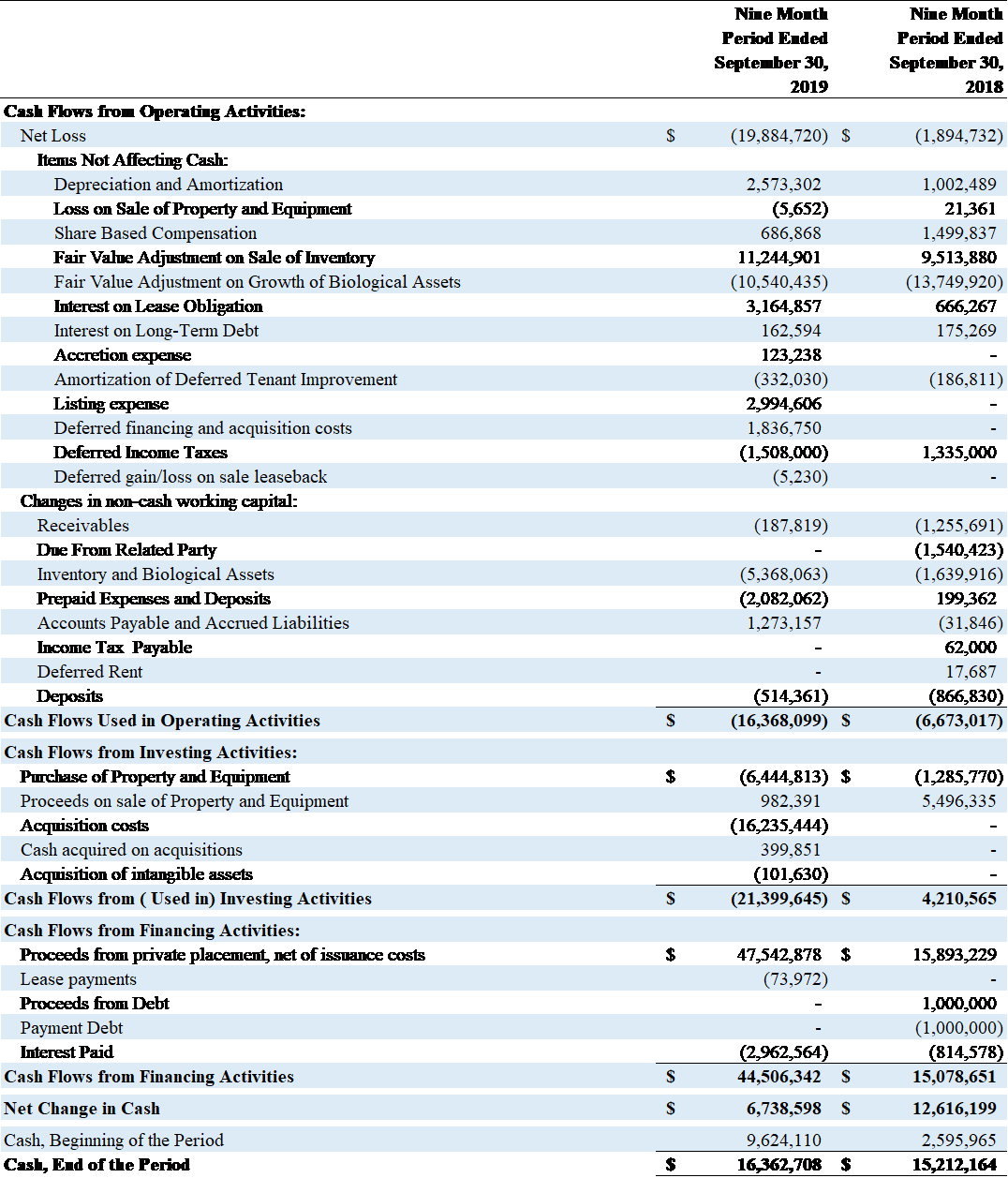

VIREO HEALTH INTERNATIONAL, INC.

(FORMERLY DARIEN BUSINESS DEVELOPMENT CORP.)

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF CASH FLOWS

(unaudited)

For the Nine Months Ended September 30, 2019 and 2018

(Expressed in United States Dollars)

Reconciliation of Non-IFRS Financial Measures

This news release contains references to financial metrics such as Pro Forma Revenue, EBITDA, Adjusted EBITDA, and Adjusted Net Income, which are non-IFRS measures and do not have standardized definitions under IFRS. The Company has provided these non-IFRS financial measures in this news release as supplemental information and in addition to the financial measures that are calculated and presented in accordance with IFRS. These supplemental non-IFRS financial measures are presented because management has evaluated the Company’s financial results both including and excluding the adjusted items and believe that the supplemental non-IFRS financial measures presented provide additional perspective and insights when analyzing the core operating performance of the Company’s business. The Company has provided reconciliations of these supplemental non-IFRS financial measures to the most directly comparable financial measures calculated and presented in accordance with International Financial Reporting Standards. Supplemental non-IFRS financial measures should not be considered superior to, as a substitute for or as an alternative to, and should be considered in conjunction with, the IFRS financial measures presented in this news release.

Reconciliation of Net Income to Adjusted Net Income and Adjusted EBITDA