Goodness Growth Holdings Announces Third Quarter 2022 Results

– Third quarter GAAP revenue of $18.9 million increased 41.0% YoY –

– Excluding discontinued operations, third quarter revenue increased 59.6% YoY –

– Company will be seeking damages from Verano; focused on maximizing value for stakeholders –

MINNEAPOLIS – November 14, 2022 – Goodness Growth Holdings, Inc. (“Goodness Growth” or the “Company”) (CSE: GDNS; OTCQX: GDNSF), a physician-led, science-focused cannabis company and IP incubator, today reported financial results for its third quarter ended September 30, 2022. All currency figures referenced in this press release reflect U.S. dollar amounts.

“Our third quarter results reflect continued revenue growth across each of our operating markets in Maryland, Minnesota, New Mexico, and New York, as well as consistency of our gross margin performance as compared to the prior quarter,” said Chairman and Chief Executive Officer, Kyle Kingsley, M.D. “Margin performance in our home market of Minnesota has been especially strong following the commencement of flower and edibles sales earlier this year, and we are also pleased with substantial increases in wholesale volumes in New York. We expect both of these positive trends to continue as we work toward the expected launch of adult-use sales in New York next year.”

Kingsley continued, “While we are experiencing positive momentum in our business, we were extremely disappointed by Verano’s decision to wrongfully repudiate our transaction, which we previously anticipated would close during the fourth quarter. We are unable to comment more on ongoing litigation beyond what has already been disclosed, but we reiterate that we believe this termination was unlawful and we will be seeking significant damages through the judicial process in British Columbia. We believe there is significant long-term value in our asset portfolio, and our management team and board of directors remains focused, as we always have been, on maximizing value for stakeholders.”

Third Quarter 2022 Financial Summary

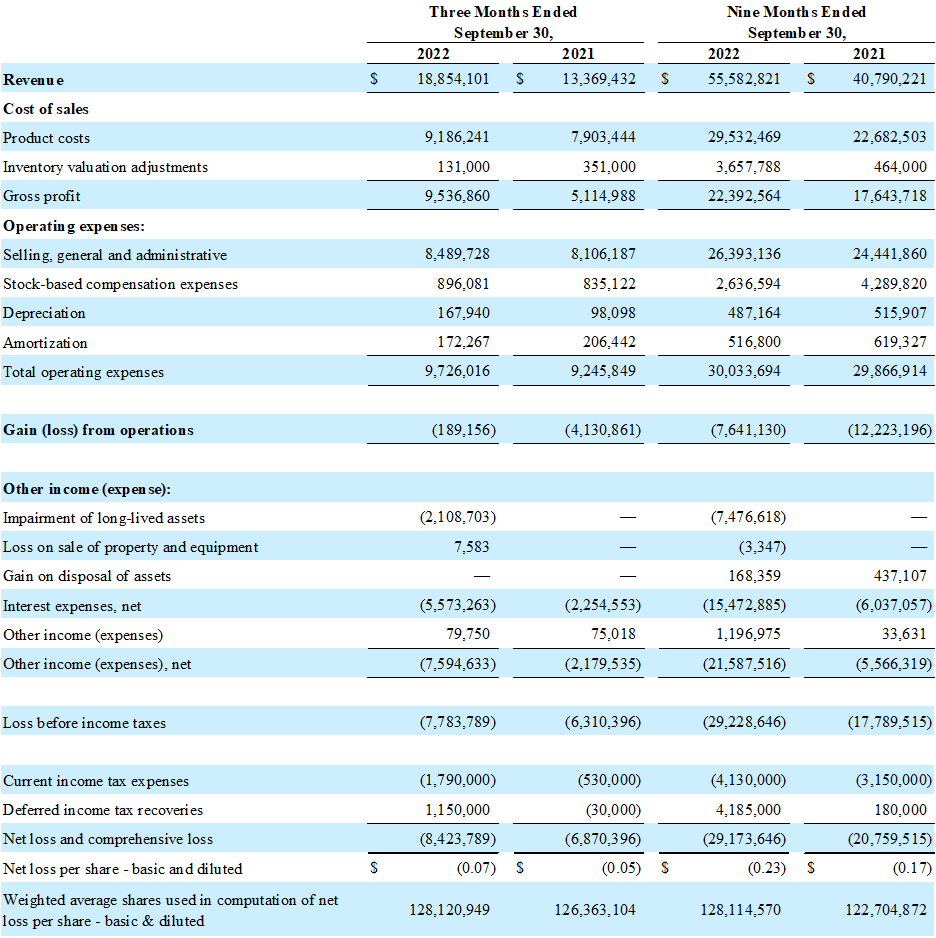

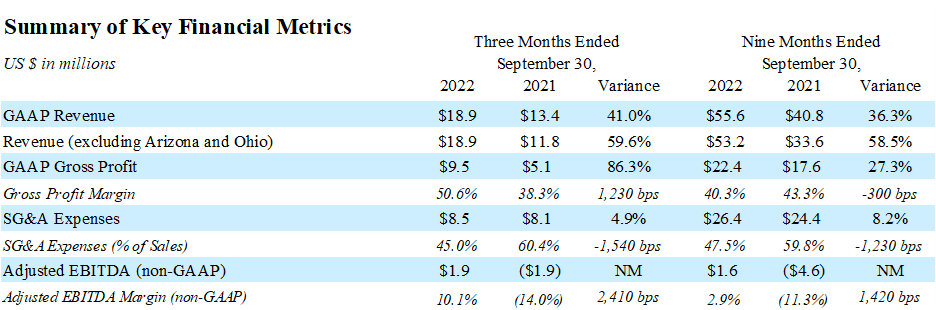

Total revenue in the third quarter was $18.9 million, an increase of 41.0 percent as compared to Q3 2021. Excluding contributions from discontinued operations in Arizona, total revenue increased 59.6 percent and reflected strong growth in each of the Company’s operating markets. Retail revenue excluding Arizona increased 60.1 percent to $16.4 million in Q3 2022. Wholesale revenue excluding Arizona increased by 56.1 percent to $2.5 million, driven by increased sales in Maryland and New York.

Gross profit was $9.5 million, or 50.6 percent of revenue, as compared to gross profit of $5.1 million or 38.3 percent of revenue in Q3 last year. The improvement in gross margin was primarily driven by increased retail sales in Minnesota, as well as the discontinuation of operations in Arizona during the second quarter.

Total operating expenses in the third quarter were $9.7 million, an increase of $0.5 million as compared to $9.2 million in the third quarter of 2021. The increase in total expenses was primarily attributable to an increase in professional fees related to the former agreement to be acquired by Verano Holdings Corp.

Operating loss in the third quarter was $0.2 million, a decrease of $3.9 million compared to an operating loss of $4.1 million in Q3 last year. The improvement in operating performance was driven by increased revenue and gross profit dollars, partially offset by the increase in total operating expenses.

Total other expenses were $7.6 million during Q3 2022, compared to $2.2 million in Q3 2021. The variance in other expenses is primarily attributable to increased interest expense related to the Company’s credit facility, and an impairment of long-lived assets of $2.1 million.

Net loss in Q3 2022 was $8.4 million, as compared a loss of $6.9 million in Q3 2021. The variance compared to the prior year was driven by the improvement in operating income, offset by increased interest expenses and an impairment of long-lived assets.

EBITDA, as described in accompanying non-GAAP reconciliation, was a loss of $1.2 million during Q3 2022, compared to a loss of $3.1 million in Q3 2021. Adjusted EBITDA was $1.9 million in Q3 2022, as compared to a loss of $1.9 million in Q3 2021. Please refer to the Supplemental Information and Reconciliation of Non-GAAP Financial Measures at the end of this press release for additional information.

Other Events

On August 25, 2022, the Company announced the launch of its Boundary Waters line of premium cannabis pre-rolls focused on sustainability and environmental preservation. Inspired by Minnesota’s Boundary Waters Canoe Area Wilderness, which exists within Superior National Forest, Boundary Waters pre-rolls are hand-rolled from premium whole flower and are available in Sativa, Indica and hybrid strains, and can be purchased in five-roll packs.

On October 13, 2022, Goodness Growth received a notice (the “Notice”) of purported termination of the agreement (the “Arrangement Agreement”) with Verano Holdings Corp. (“Verano”) pursuant to which Verano had agreed to purchase all of the Company’s stock, subject to the satisfaction of certain conditions. The Notice asserted certain breaches of the Arrangement Agreement, including claims the Company’s public filings and communications with respect to its business and ongoing operations were misleading and that the Company breached its representations to Verano under the Arrangement Agreement. Verano also claimed, as a result of such breaches, it is entitled to payment of the $14,875,000 termination fee and its transaction expenses. Goodness Growth denies all of Verano’s allegations and affirmatively states that it has complied with its obligations under the Arrangement Agreement in all material respects at all times. Goodness Growth believes that Verano has no factual or legal basis to justify or support its purported grounds for termination of the Arrangement Agreement.

On October 21, 2022, Goodness Growth commenced an action in the Supreme Court of British Columbia against Verano arising out of Verano wrongfully repudiating the Arrangement Agreement. The Company is seeking damages costs and interest, based on Verano’s breach of contract and of its duty of good faith and honest performance. Due to uncertainties inherent in litigation, it is not possible for Goodness Growth to predict the timing or final outcome of the legal proceedings against Verano or to determine the amount of damages, if any, that may be awarded.

Company Continues to Explore Strategic Alternatives

As a result of the termination of the Arrangement Agreement with Verano Holdings Corp., the Goodness Growth Board of Directors and its Transaction Committee, which was formed to explore strategic alternatives for the Company in the third quarter of 2021, remain focused on maximizing value for stakeholders. The Committee, with the assistance of outside advisors, ran a thorough sale process and received multiple indications of interest prior to announcing the Arrangement Agreement with Verano on February 1, 2022. The Board of Directors and Committee continue to evaluate strategic alternatives for the Company, which could include a disposition of a material business or assets of the Company, or a merger or sale of the Company. The Company has not set a timetable for the completion of this review process.

Balance Sheet and Liquidity

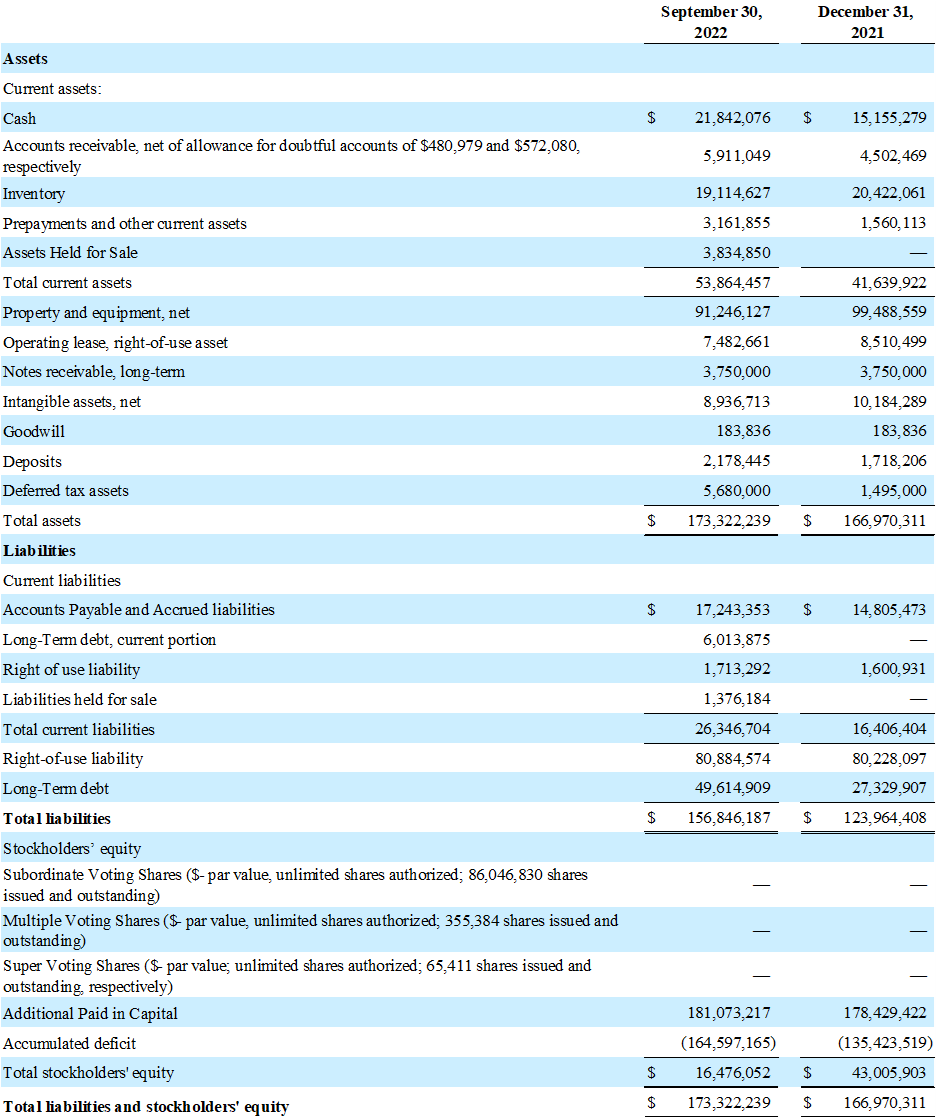

As of September 30, 2022, the Company had 128,126,330 equity shares issued and outstanding on an as-converted basis, and 158,380,087 shares outstanding on an as-converted, fully diluted basis.

As of September 30, 2022, total current assets were $53.9 million. The Company had cash on hand of $21.8 million, which included net proceeds received from an increase on its delayed draw loan of $8.5 million during the third quarter. Total current liabilities were $26.3 million.

Conference Call and Webcast Information

Goodness Growth management will host a conference call with research analysts tomorrow, Tuesday,

November 15, 2022 at 8:30 a.m. ET (7:30 a.m. CT) to discuss its financial results for its third quarter ended

September 30, 2022. Interested parties may attend the conference call by dialing 1-888-660-6217 (Toll-Free) (US and Canada) or 1-929-203-1990 (Toll) (International) and referencing conference ID number 2214400.

A live audio webcast of this event will also be available in the Events & Presentations section of the Company’s Investor Relations website and via the following link:

https://events.q4inc.com/attendee/270373966.

About Goodness Growth Holdings, Inc.

Goodness Growth Holdings, Inc., is a physician-led, science-focused holding company whose mission is to bring the power of plants to the world. The Company’s operations consist primarily of its multi-state cannabis company subsidiary, Vireo Health, Inc., and its science and intellectual property incubator, Resurgent Biosciences, Inc. The Company manufactures proprietary, branded cannabis products in environmentally friendly facilities and state-of-the-art cultivation sites, and distributes its products through its growing network of Green Goods® and other retail locations and third-party dispensaries. Its team of more than 450 employees are focused on the development of differentiated products, driving scientific innovation of plant-based medicines and developing meaningful intellectual property. Today, the Company is licensed to grow, process, and/or distribute cannabis in five markets and operates 18 dispensaries across the United States. For more information about Goodness Growth Holdings, please visit www.goodnessgrowth.com.

Additional Information

Additional information relating to the Company’s third quarter 2022 results will be available on EDGAR and SEDAR on November 14, 2022. Goodness Growth refers to certain non-GAAP financial measures such as Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) and adjusted EBITDA (defined as earnings before interest, taxes, depreciation, and amortization, less certain non-cash equity compensation expense, one-time transactions, and other non-recurring non-cash items. These measures do not have any standardized meaning and may not be comparable to similar measures presented by other issuers. Please see the Supplemental Information and Reconciliation of Non-GAAP Financial Measures at the end of this news release for more detailed information regarding non-GAAP financial measures.

Contact Information

Investor Inquiries:

Sam Gibbons

Vice President, Investor Relations

samgibbons@goodnessgrowth.com

(612) 314-8995

Media Inquiries:

Amanda Hutcheson

Corporate Communications

amandahutcheson@goodnessgrowth.com

(919) 815-1476

Forward-Looking Statement Disclosure

This press release contains “forward-looking information” within the meaning of applicable United States and Canadian securities legislation. To the extent any forward-looking information in this press release constitutes “financial outlooks” within the meaning of applicable United States or Canadian securities laws, such information is being provided as preliminary financial results and the reader is cautioned that this information may not be appropriate for any other purpose and the reader should not place undue reliance on such financial outlooks. Forward-looking information contained in this press release may be identified by the use of words such as “should,” “estimate,” “would,” “looking forward,” “may,” “continue,” “expect,” “expected,” “will,” “believe,” “subject to,” and “pending,” or variations of such words and phrases. These statements should not be read as guarantees of future performance or results. Forward-looking information includes both known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements of the Company or its subsidiaries to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements or information contained in this press release. Financial outlooks, as with forward-looking information generally, are, without limitation, based on the assumptions and subject to various risks as set out herein and in our Annual Report on Form 10-K filed with the Securities Exchange Commission. Our actual financial position and results of operations may differ materially from management’s current expectations and, as a result, our revenue, adjusted EBITDA, and cash on hand may differ materially from the values provided in this press release. Forward-looking information is based upon a number of estimates and assumptions of management, believed but not certain to be reasonable, in light of management’s experience and perception of trends, current conditions, and expected developments, as well as other factors relevant in the circumstances, including assumptions in respect of current and future market conditions, the current and future regulatory environment, and the availability of licenses, approvals and permits.

Although the Company believes that the expectations and assumptions on which such forward-looking information is based are reasonable, undue reliance should not be placed on the forward-looking information because the Company can give no assurance that they will prove to be correct. Actual results and developments may differ materially from those contemplated by these statements. Forward-looking information is subject to a variety of risks and uncertainties that could cause actual events or results to differ materially from those projected in the forward-looking information. Such risks and uncertainties include, but are not limited to, risks related to the timing of adult-use legislation in markets where the Company currently operates; current and future market conditions, including the market price of the subordinate voting shares of the Company; risks related to the COVID-19 pandemic; federal, state, local, and foreign government laws, rules, and regulations, including federal and state laws and regulations in the United States relating to cannabis operations in the United States and any changes to such laws or regulations; operational, regulatory and other risks; execution of business strategy; management of growth; difficulties inherent in forecasting future events; conflicts of interest; risks inherent in an agricultural business; risks inherent in a manufacturing business; liquidity and the ability of the Company to raise additional financing to continue as a going concern; the timing of adult-use sales in New York [and Maryland]; the Company’s ability to meet the demand for flower in Minnesota; risk of failure in recovering damages sought from Verano; our ability to dispose of our assets held for sale at an acceptable price or at all; and risk factors set out in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021, which is available on EDGAR with the U.S. Securities and Exchange Commission and filed with the Canadian securities regulators and available under the Company’s profile on SEDAR at www.sedar.com.

The statements in this press release are made as of the date of this release. Except as required by law, we undertake no obligation to update any forward-looking statements or forward-looking information to reflect events or circumstances after the date of such statements.

Supplemental Information

The financial information reported in this news release is based on unaudited financial statements for the fiscal quarters ended September 30, 2022 and September 30, 2021. All financial information contained in this news release is qualified in its entirety with reference to such financial statements. To the extent that the financial information contained in this news release is inconsistent with the information contained in the Company’s audited financial statements, the financial information contained in this news release shall be deemed to be modified or superseded by the Company’s audited financial statements. The making of a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation for purposes of applicable securities laws.

GOODNESS GROWTH HOLDINGS, INC.

CONSOLIDATED BALANCE SHEETS AS OF SEPTEMBER 30, 2022 AND DECEMBER 31, 2021

(Amounts Expressed in United States Dollars, Unaudited and Condensed)

GOODNESS GROWTH HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2022 AND 2021

(Amounts Expressed in United States Dollars, Unaudited and Condensed)

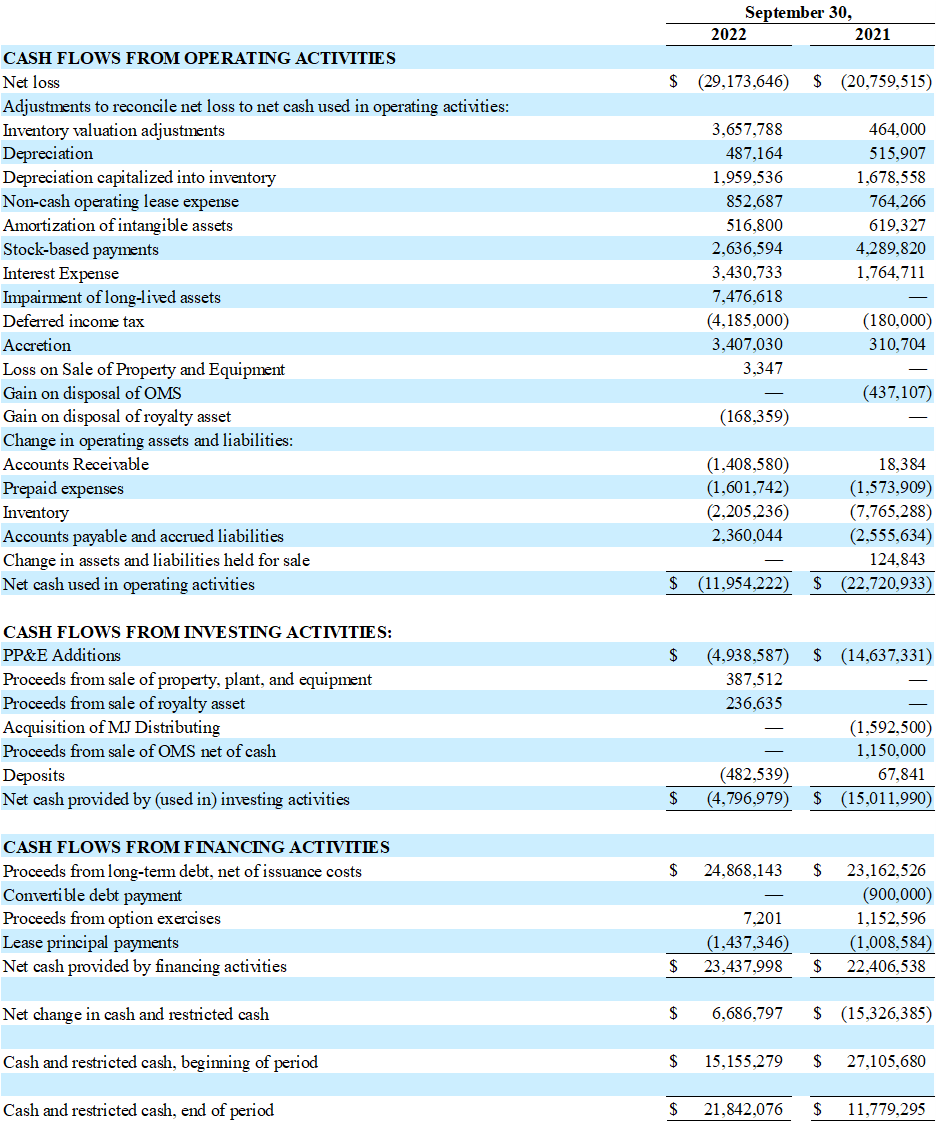

GOODNESS GROWTH HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

NINE MONTHS ENDED SEPTEMBER 30, 2022 AND 2021

(Amounts Expressed in United States Dollars, Unaudited and Condensed)

Reconciliation of Non-GAAP Financial Measures

EBITDA and Adjusted EBITDA are non-GAAP measures and do not have standardized definitions under GAAP. The following information provides reconciliations of the supplemental non-GAAP financial measures, presented herein to the most directly comparable financial measures calculated and presented in accordance with GAAP. The Company has provided the non-GAAP financial measures, which are not calculated or presented in accordance with GAAP, as supplemental information and in addition to the financial measures that are calculated and presented in accordance with GAAP. These supplemental non- GAAP financial measures are presented because management has evaluated the financial results both including and excluding the adjusted items and believe that the supplemental non-GAAP financial measures presented provide additional perspective and insights when analyzing the core operating performance of the business. These supplemental non-GAAP financial measures should not be considered superior to, as a substitute for or as an alternative to, and should be considered in conjunction with, the GAAP financial measures presented.

Reconciliation of Net Loss to EBITDA and Adjusted EBITDA

(Amounts Expressed in United States Dollars, Unaudited and Condensed)